Make your first $50k/yr in Passive Income with Alternative Investments.

From workshops to investment opportunities, we help you diversify your portfolio from the stock market, reduce your annual tax bill, and grow your cashflow with alternative investments.

Schedule a Discovery Call to Learn More

What Are Private Placements?

Private placements are a fundraising method utilized by non-public companies to raise money without the expenses and regulatory obligations associated with going public (i.e. an Initial Public Offering or IPO). You likely haven't heard of them because they are typically restricted to accredited investors by the SEC. By investing in private placements, accredited investors are able to invest in less regulated, and therefore higher yielding opportunities to grow their cashflow.

Say hello to a new way of growing your cashflow

Private placements are one of the fastest growing investment channels in the world making them an ideal tool to use in your investment portfolio and helping you diversify grow & your cashflow.

With over $10T going into private placements each year, we put you in front of the deal flow that will help you grow your cashflow.

What Are The Benefits Of Private Placements?

Being an accredited investor is different than the opportunities available to you before you hit $1M in networth. But most accredited investors aren't aware of all the new tools they can use to deploy their money to match their goals after they reach a level of financial success.

By strategically investing in private placements, you'll be able to shield a portion of your portfolio from the volatility of the stock market, diversify your wealth so that you aren't overallocated to one asset class, and most importantly, grow and diversify your income streams.

By investing in private placements, you not only are able to invest directly with best-in-class fund managers, but you also win back your time by investing in opportunities that are truly passive.

"Private Placements are where I invest over 80% of my money. Once I found operators that I could trust, I've been able to grow my cashflow & net worth consistently, passively, and uncorrelated to the stock market. "

Here Are 3 Ways We Help You Grow Your Cashflow With Private Placements

Source

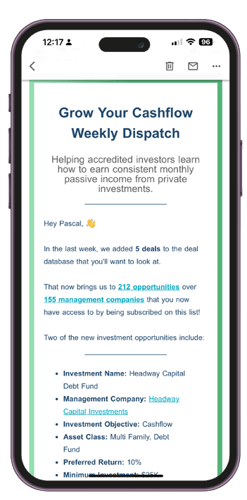

Join our weekly dispatch email list for a full list of all investment opportunities we've come across each week!

Learn

Follow us on your favorite social media platform and get bitesized tips through reels, or dive deeper into passive investing topics with our Podcast.

Earn

If you'd like to invest in low risk, monthly passive income offerings with best in class operators, check out our Offerings.

See what people are saying

"I often find deals through the weekly dispatch that I would not have found otherwise.

The Grow Your Cashflow Weekly Dispatch has been great in improving my access to investment opportunities."

"I think what you're building with this community is great.

There's so much misinformation out there and the education you're providing here will save investors a lot of heartache at the beginning of their investing career"

"I am in huge support of what you're on at Grow Your Cashflow.

Private investments are where we find our most lucrative deals but there hasn't really been a great resource that educates LPs on the many pitfalls of making poor investment decisions."